Showing posts with label Economic Development. Show all posts

Showing posts with label Economic Development. Show all posts

Thursday, 24 November 2011

Friday, 22 April 2011

An intelligent use for Rhosgoch.

|

| The disused Shell site at Rhosgoch: time to put it to good use. |

This proposal would effectively kill two birds with one stone. Firstly a new and dedicated estate for housing workers would ensure that a large proportion of the Island's tourist accommodation is not displaced during Wylfa B's construction – it would be difficult to grow our tourism industry if all the existing tourist accommodation was taken up by Wylfa workers. Secondly it finally finds a fantastic dual-purpose use for the Rhosgoch site, which has remained as wasteland ever since it was donated to the Island by Shell back in the 1980s. The influx of holiday makers to such an attraction would also provide an invaluable long-term boost in the arm to the economy of Amlwch and its surrounding area.

Its worth pointing out that a suggestion to convert the Rhosgoch site into exactly this kind of attraction was included in the crowd-sourced 'People's Manifesto for Ynys Môn', created by contributors to this blog last July:

'The Council should consider promoting the creation of a unique, big attraction somewhere on the Island which combines Anglesey’s strengths (its suitability as a water sports venue coupled with its proximity to the Snowdonia National Park) and has the potential to attract new visitors from Liverpool, Manchester, the Midlands and elsewhere in North Wales - without cannibalising existing businesses in the way, for example, a retail park would. One suggestion would be something like a ‘Centre Parc’ crossed with the ‘Eden Project’ crossed with the ‘Coed y Brenin’ Mountain Biking Centre. Such an attraction could offer visitors boating, walking, riding, various cycling paths, swimming pools with slides and waves, etc. - and all within a short distance from other activities in Snowdonia National Park. The facility would also offer tiered accommodation and a network of shops and restaurants. The council’s role would be to identify a suitable site, provide access roads, car parks, drainage, and then find a suitable private company to build and operate the site. The old Shell site at Rhosgoch might be a suitable location for this attraction - it belongs to the council, has remained unused for 20 years, is fairly tranquil and is close to the sea."

Read the whole thing here.

Thursday, 21 April 2011

“They're more interested in making the backs of the buildings look nice for the ferries”

|

| The Daily Post backs Enterprise Zone status for Holyhead |

There are of course no silver bullets for the economic problems being faced in Holyhead or, indeed, all over Ynys Môn. But one thing is certain: you cannot continue to do the same things and expect different outcomes. The time has come to try something radically different and that is why I have been pushing for Holyhead to become the first Enterprise Zone in Wales. Announced in last month’s Budget, 21 Enterprise Zones will be set up in England, with the closest one to us being in Wirral Waters, Birkenhead. As Economic Development is devolved in Wales, WAG has now received £65m as the ‘Barnett consequential’ of this policy and it will be up to the new Welsh Government to decide post May 5th how to use this money. I sincerely hope that WAG will give serious thought to introducing a similar Enterprise Zone policy here in Wales due to their terrific potential to help revive some of our most economically struggling areas – and to this end, I’m delighted that the Daily Post has also come out in support of my calls for Holyhead to become Wales’ first Enterprise Zone (see image above).

In terms of the specifics of Enterprise Zones, the Welsh Conservatives would push for the following:

- tax breaks for both existing and new businesses – including the lifting of business rates and discussions with Westminster on the possibility of also obtaining corporation tax reductions

- simplified planning rules to assist businesses setting up or expanding

- the roll out of super-fast broadband

It is also important to note that the benefits of having an Enterprise Zone in Holyhead would not be just confined to Holyhead. As Ynys Môn’s largest town, it is in the interests of the Island as a whole to have a thriving, profitable and growing economy in Holyhead. Enterprise Zones have their critics, but quite frankly, its time to try something new and radical in Holyhead: to simply carry on tinkering around the edges will not change anything.

Wednesday, 9 March 2011

Struck by Lightning...

Over the last couple of years I wonder how many electric car makers have come specifically to Anglesey wanting to set up a manufacturing plant in Holyhead, potentially employing up to 400 people?

There must have been a great many because apparently our AM, Ieuan Wyn Jones, can't remember having met with one in September 2009 -- just as Anglesey Aluminium finally closed its gates with a loss of 450 jobs and three months before Holyhead's Eaton Electric also closed losing another 240 jobs. I would have thought that at a time of huge job losses in one of the poorest parts of Ynys Môn a clean tech, cutting edge company wanting to set up in Holyhead would have been welcomed with open arms by the Island's AM. Instead he is quoted in today's Holyhead and Anglesey Mail as saying, "I don't really remember the meeting"...

Following some leads I discovered through an FoI request that in September 2009 Ieuan Wyn Jones AM met with the management of Lightning Car Company together with senior councillors and officers from the economic development unit and Brynle Williams, "on the topic of startup electric car business on the island". According to Cllr Bryan Owen, who attended the meeting and was then the Economic Development portfolio holder, "They [Lightning] were very impressed with the port and road infrastructure. They were keen to move forward and it was left to the Assembly Government to come up with some funding and that's where it died a death as far as I'm aware".

Manufacturing opportunities need to be grasped with both hands when they come along. They provide the kind of mass work we need on this island, and they also require a mix of skilled, semi-skilled and low-skilled workers thus providing job opportunities across the board. Furthermore Electric cars may still be niche currently but they are undoubtedly the future of motoring and the sector will grow and grow from now on -- particularly considering the effect on oil prices due to the current turmoil in the Middle East. Imagine the symbolism of manufacturing electric cars on the 'Energy Island' -- it would have been a tremendous boost to the standing of Ynys Môn.

The final point to mention is that this company wanted to set up at Parc Cybi industrial estate (also known as Tŷ Mawr) just off junction 2 of the A55 in Holyhead. WAG poured millions of pounds into setting up the site, buying the land, connecting it with a fibre-optic internet connection, funding an (ongoing) archeological survey of the land, and putting in the road infrastructure to serve it. Yet several years after completion it is still completely empty; not a single company has set up there and the land is now only used for grazing. Parc Cybi is in effect the most expensive sheep grazing land in the whole of North Wales, and those sheep enjoy a better internet connection than 99% of the human inhabitants of this island!

There must have been a great many because apparently our AM, Ieuan Wyn Jones, can't remember having met with one in September 2009 -- just as Anglesey Aluminium finally closed its gates with a loss of 450 jobs and three months before Holyhead's Eaton Electric also closed losing another 240 jobs. I would have thought that at a time of huge job losses in one of the poorest parts of Ynys Môn a clean tech, cutting edge company wanting to set up in Holyhead would have been welcomed with open arms by the Island's AM. Instead he is quoted in today's Holyhead and Anglesey Mail as saying, "I don't really remember the meeting"...

Following some leads I discovered through an FoI request that in September 2009 Ieuan Wyn Jones AM met with the management of Lightning Car Company together with senior councillors and officers from the economic development unit and Brynle Williams, "on the topic of startup electric car business on the island". According to Cllr Bryan Owen, who attended the meeting and was then the Economic Development portfolio holder, "They [Lightning] were very impressed with the port and road infrastructure. They were keen to move forward and it was left to the Assembly Government to come up with some funding and that's where it died a death as far as I'm aware".

Manufacturing opportunities need to be grasped with both hands when they come along. They provide the kind of mass work we need on this island, and they also require a mix of skilled, semi-skilled and low-skilled workers thus providing job opportunities across the board. Furthermore Electric cars may still be niche currently but they are undoubtedly the future of motoring and the sector will grow and grow from now on -- particularly considering the effect on oil prices due to the current turmoil in the Middle East. Imagine the symbolism of manufacturing electric cars on the 'Energy Island' -- it would have been a tremendous boost to the standing of Ynys Môn.

The final point to mention is that this company wanted to set up at Parc Cybi industrial estate (also known as Tŷ Mawr) just off junction 2 of the A55 in Holyhead. WAG poured millions of pounds into setting up the site, buying the land, connecting it with a fibre-optic internet connection, funding an (ongoing) archeological survey of the land, and putting in the road infrastructure to serve it. Yet several years after completion it is still completely empty; not a single company has set up there and the land is now only used for grazing. Parc Cybi is in effect the most expensive sheep grazing land in the whole of North Wales, and those sheep enjoy a better internet connection than 99% of the human inhabitants of this island!

Thursday, 17 February 2011

Five months of inaction.

Amid much fanfare last July the WAG Minister for the Economy and our AM, Ieuan Wyn Jones launched his flagship "Economic Renewal Programme" (ERP), a fundamental rethink of WAG's economic development policies which, according to the bumf, aimed to make Wales "one of the best places to in the world to live and work".

The ERP is predicated upon moving away from a system of grants to one of repayable loans - something which I approve of. To do this the ERP superseded the Single Investment Fund (WAG's then central funding 'pot' for business support grants) which was then closed to new applicants on the same day that the ERP was announced.

Recently I made a Freedom of Information request to discover how many repayable loans had been made via the Economic Renewal Programme since its launch in July 2010.

Would anyone care to make a guess?

The answer is zero. Not a single repayable loan has been offered to a Welsh company in the seven months since the introduction of the ERP. Companies which were at an 'advanced stage' of their Single Investment Fund application were allowed further time to submit their applications by 31 August 2010 -- but since that date there has been no new business support funds available from WAG to any Welsh companies.

In other words despite the precariousness of the economic recovery, the Department for the Economy and Transport has effectively been a 'closed shop' for five months whilst it rearranges the deck chairs in setting up the sector panels which will eventually begin awarding repayable loans.

Remember that next time a Welsh company is in trouble and the Labour-Plaid coalition in Cardiff Bay points its finger at the Westminster government.

The ERP is predicated upon moving away from a system of grants to one of repayable loans - something which I approve of. To do this the ERP superseded the Single Investment Fund (WAG's then central funding 'pot' for business support grants) which was then closed to new applicants on the same day that the ERP was announced.

Recently I made a Freedom of Information request to discover how many repayable loans had been made via the Economic Renewal Programme since its launch in July 2010.

Would anyone care to make a guess?

The answer is zero. Not a single repayable loan has been offered to a Welsh company in the seven months since the introduction of the ERP. Companies which were at an 'advanced stage' of their Single Investment Fund application were allowed further time to submit their applications by 31 August 2010 -- but since that date there has been no new business support funds available from WAG to any Welsh companies.

In other words despite the precariousness of the economic recovery, the Department for the Economy and Transport has effectively been a 'closed shop' for five months whilst it rearranges the deck chairs in setting up the sector panels which will eventually begin awarding repayable loans.

Remember that next time a Welsh company is in trouble and the Labour-Plaid coalition in Cardiff Bay points its finger at the Westminster government.

Wednesday, 12 January 2011

Pass the parcel in Holyhead.

I would add this however: Ieuan Wyn Jones is this time quoted by the BBC as saying, "There is a fantastic potential for renewable energy projects but because ports are not a devolved issue, it is inappropriate for us to be allocating resources towards it". In other words, Ieuan Wyn Jones recognises what a fantastic opportunity this could be, but would rather try to score political points against Westminster than take action to create well paid jobs in one of the poorest towns in Wales.

|

| Alex Salmond and Li Keqiang raising a glass to scottish pragmatism (Photo: LA Times) |

Thursday, 16 December 2010

One Wales? or Three Wales?

|

| How we are linked by human connections as mapped by analysing phone-calls Source: The Economist |

Researchers from the Massachusetts Institute of Technology (MIT) have analysed 12 billion of phone calls within the UK in 2005 to find which regional clusters communicate with each other most and to see how they corresponds to the official administrative borders. The study's hypothesis in a nutshell is that the more and longer people in two locations talk on the phone, the more likely there are human connections binding those those places together into a cluster.

The results show that Scotland is the most cohesive region in the UK, with more than 75% of all calls originating in Scotland calling other parts of Scotland.

It is the results for Wales which are most fascinating to me -- showing that there are three distinct regions within Wales with only limited human interaction between North, South and large portions of mid Wales. North Wales in particular is much more linked in terms of human interaction with Liverpool, Manchester and the North West of England, with between 65-75% of all phonecalls originating in this area being to other places in North Wales and the North West.

What does this tell us?

|

| GVA per head variation between regions. Following Wales the North West is the next poorest. Click to enlarge |

- It shows that North Wales's economy is inextricably linked to that of Liverpool, Manchester and North West England. This fact is reinforced when you look at the relative GVA per head figures between regions. After Wales (with Anglesey at the bottom) the next poorest region is the North West (with nearby Wirral at the bottom). For North Wales to grow, it is essential for the North West to also grow, therefore there should be much more communication and collaboration between WAG and the North West in terms of economic development.

- In terms of tourism, it shows that the natural market to attract visitors is from the cities of Liverpool, Manchester and the North West. As there are already plentiful human relationships between us, strategically promoting Anglesey as a destination to these regions should be like pushing against an open door.

Thursday, 9 December 2010

++ Ynys Môn still poorest place in UK ++

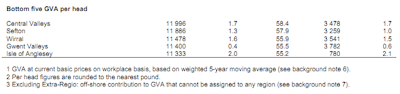

According to the latest GVA per head figures for 2008 released by the Office for National Statistics this morning, Anglesey is still the poorest locale in the whole United Kingdom:

If we compare the bottom five for 2008 with those for 2007 the one bright spot is that at least Conwy and Denbighshire has managed move up and out.

Personally I'm not surprised to find Ynys Môn still stuck to the bottom of the prosperity league table. I don't know about you but I haven't detected a sense of urgency by the Welsh Assembly Government to tackle Anglesey's economic problems. Just last week we learned that Holyhead is the worst place in Wales to find a job with 7.4 benefit claimants for every advertised job. The latest official data regarding European convergence funding on Anglesey revealed how over three years only 102 new jobs have been created on the Island -- compared to a University of Wales estimate of 2,100 private sector jobs having been lost over roughly the same period. Similarly, the EU JEREMIE funding figures revealed that Anglesey-based companies had received less than 0.1 percent of the total spent in Wales. On top of that, Agriculture -- one of the Island's largest employers -- has been in decline for some time and likely to suffer further due to the expected abysmal uptake of the new WAG Glastir agri-environmental scheme. Do either our current AM or MP have a vision or a plan how to improve the situation...?

|

| Bottom five GVA per head 2008 click to enlarge |

If we compare the bottom five for 2008 with those for 2007 the one bright spot is that at least Conwy and Denbighshire has managed move up and out.

|

| Comparing the Bottom Five for 2007 and 2008 click to enlarge |

Personally I'm not surprised to find Ynys Môn still stuck to the bottom of the prosperity league table. I don't know about you but I haven't detected a sense of urgency by the Welsh Assembly Government to tackle Anglesey's economic problems. Just last week we learned that Holyhead is the worst place in Wales to find a job with 7.4 benefit claimants for every advertised job. The latest official data regarding European convergence funding on Anglesey revealed how over three years only 102 new jobs have been created on the Island -- compared to a University of Wales estimate of 2,100 private sector jobs having been lost over roughly the same period. Similarly, the EU JEREMIE funding figures revealed that Anglesey-based companies had received less than 0.1 percent of the total spent in Wales. On top of that, Agriculture -- one of the Island's largest employers -- has been in decline for some time and likely to suffer further due to the expected abysmal uptake of the new WAG Glastir agri-environmental scheme. Do either our current AM or MP have a vision or a plan how to improve the situation...?

Thursday, 2 December 2010

Helping Holyhead and Ynys Môn to create jobs

According to figures compiled by the GMB Union, Holyhead has the most jobseekers per vacancy in Wales. This month there are 781 unemployed claimants in Holyhead chasing just 105 unfilled job vacancies -- a ratio of 7.4 potential applicants per job. Bangor, Caernarfon and Llangefni are in 17th place, with 2,138 unemployed claimants chasing 1,077 job vacancies -- a ratio of 2 applicants per job.

Holyhead in particular was severely hit by the recession -- two of its largest employers, both of which had been operating in Holyhead for well over 35 years -- closed within three months of each other at the end of 2009:

Between them they directly accounted for 700 jobs, not including all the other jobs in small suppliers, support industries, and shops which depended on their trade.

Large companies like Anglesey Aluminium and Eaton Electric cannot be replaced overnight, and it is for that reason that the economic wellbeing of Holyhead and Anglesey must rest with its indigenous small businesses -- a point explicitly addressed in the People's Manifesto:

Not only does this make good common-sense, it is also backed up by research: for example studies show that nearly two-thirds of all net new jobs in the United States in 2007 were created by companies less than five years old. Therefore it is clear that a country such as Wales which suffers from an under-developed private sector should strategically focus on providing support to its small businesses as a way of growing the number of private sector jobs.

Unfortunately the economic development policies currently being pursued by the Welsh Assembly Government -- Ieuan Wyn Jones's "Economic Renewal Programme" -- do the exact opposite: i.e. they support a few large employers in Wales at the expense of the multitudes of small businesses. It has done this by limiting the amount of economic support available and then restricted it only to companies operating in six "key sectors":

How were these sectors chosen? Nobody knows. The majority of companies operating in these sectors are not small companies. And most importantly to us, none of them (with the possible exception of energy companies) are well represented on Ynys Môn as is clear from the following breakdown of workplace employment sectors in Anglesey and North Wales:

As you can see: Anglesey has a large distribution and transport sector thanks to Holyhead port, fair sized construction and production industries (although this data was collated before the closure of AAM and Eaton, etc.), and the largest proportion of people in North Wales working in areas related to agriculture and food production. None of these sectors are supported by the Economic Renewal Programme and therefore do not qualify for any support. Financial services are supported but, as you can see, Anglesey has the lowest proportion of these companies in the whole of North Wales.

As Anglesey has the highest proportion of people working in Agriculture sector in North Wales it is also important to note that there are severe problems here also. Single Farm payments are denominated in Euros, whose value is falling against sterling because of economic turmoil in Europe. Furthermore the current existing WAG agri-environmental schemes (Tir Gofal, Tir Mynydd, Tir Cynnal, and the Organic farming Scheme) are in the process of being phased out and replaced by the over complicated and widely derided Glastir scheme. Indeed at a meeting I recently attended of the Anglesey Grassland Society, out of approximately 40 farmers present, only one said he was applying for Glastir. There is trouble ahead.

So what can be done to help the situation in Holyhead and the rest of Ynys Môn?

If you have any more ideas or suggestions, please do let me know.

Holyhead in particular was severely hit by the recession -- two of its largest employers, both of which had been operating in Holyhead for well over 35 years -- closed within three months of each other at the end of 2009:

- Anglesey Aluminium started smelting in 1971 and continued production all the way through the 80s and 90s, only closing with a loss of 450 jobs in September 2009

- The Eaton Electric plant in Holyhead opened in 1960 under the name Midland Electric Manufacturing Company, it operated all through the 80s and 90s and closed in December 2009 with a loss of 250 jobs

Between them they directly accounted for 700 jobs, not including all the other jobs in small suppliers, support industries, and shops which depended on their trade.

Large companies like Anglesey Aluminium and Eaton Electric cannot be replaced overnight, and it is for that reason that the economic wellbeing of Holyhead and Anglesey must rest with its indigenous small businesses -- a point explicitly addressed in the People's Manifesto:

"the Council needs to recognise that the Island’s economic future rests on promoting and supporting multitudes of small businesses - not just one or two large employers. Accordingly the Council must: (a) avoid supporting developments which merely contribute to the cannibalisation of sales from existing small businesses and shops; (b) prioritise reducing the bureaucracy and costs involved in running small businesses on the Island; (c) provide meaningful and high-quality support to encourage both the growth of existing small businesses and the establishment of new ventures."

Not only does this make good common-sense, it is also backed up by research: for example studies show that nearly two-thirds of all net new jobs in the United States in 2007 were created by companies less than five years old. Therefore it is clear that a country such as Wales which suffers from an under-developed private sector should strategically focus on providing support to its small businesses as a way of growing the number of private sector jobs.

Unfortunately the economic development policies currently being pursued by the Welsh Assembly Government -- Ieuan Wyn Jones's "Economic Renewal Programme" -- do the exact opposite: i.e. they support a few large employers in Wales at the expense of the multitudes of small businesses. It has done this by limiting the amount of economic support available and then restricted it only to companies operating in six "key sectors":

- Creative industries

- Information Communication Technologies

- Energy and Environment

- Advanced material and manufacturing

- Life Sciences

- Financial and Professional services

How were these sectors chosen? Nobody knows. The majority of companies operating in these sectors are not small companies. And most importantly to us, none of them (with the possible exception of energy companies) are well represented on Ynys Môn as is clear from the following breakdown of workplace employment sectors in Anglesey and North Wales:

As you can see: Anglesey has a large distribution and transport sector thanks to Holyhead port, fair sized construction and production industries (although this data was collated before the closure of AAM and Eaton, etc.), and the largest proportion of people in North Wales working in areas related to agriculture and food production. None of these sectors are supported by the Economic Renewal Programme and therefore do not qualify for any support. Financial services are supported but, as you can see, Anglesey has the lowest proportion of these companies in the whole of North Wales.

As Anglesey has the highest proportion of people working in Agriculture sector in North Wales it is also important to note that there are severe problems here also. Single Farm payments are denominated in Euros, whose value is falling against sterling because of economic turmoil in Europe. Furthermore the current existing WAG agri-environmental schemes (Tir Gofal, Tir Mynydd, Tir Cynnal, and the Organic farming Scheme) are in the process of being phased out and replaced by the over complicated and widely derided Glastir scheme. Indeed at a meeting I recently attended of the Anglesey Grassland Society, out of approximately 40 farmers present, only one said he was applying for Glastir. There is trouble ahead.

So what can be done to help the situation in Holyhead and the rest of Ynys Môn?

- WAG needs to change its focus to supporting our small indigenous Welsh businesses. It can do this by reviewing the focus of the Economic Renewal Programme and also by reviewing Business Rates -- which are currently higher in Wales than anywhere else in the UK. (the Welsh Conservatives plan to take all small companies with a rateable value of less than £12,000 out of paying business rates all together).

- More needs to be done to ensure that European funds like JEREMIE (of which Anglesey firms have so far only received 0.1% of the funds available in Wales) are better advertised and taken up by Anglesey companies.

- Closer to home, Anglesey County Council needs to recognise the dangerous effect which expanding the number of pay and display car parks will have on struggling town centre businesses. Gwynedd Council has made all car parks free during the Xmas period to help their small businesses -- why can't we do the same here? I will be pushing the Council to reconsider parking charges entirely.

- Noting the importance of Agricultural and food-based businesses in particular to Anglesey, WAG needs to consider the effectiveness of Glastir. Closer to home we need to look at how we can promote Anglesey produce better.

- Tourism will become more and more important to the Island. I have already discussed here what can be done to help the industry on Anglesey.

- And finally, Planning policies on the island needs to become more business friendly. Present policies are based on the adopted Ynys Môn Local Plan (1996) and the stopped Unitary Development Plan (2005) -- both of these documents are seriously outdated in all areas. Accordingly we need to ensure there is sufficient consultation into the new Local Development Plan (currently being jointly produced with Gwynedd Council) to make sure that planning represents Anglesey's modern needs.

If you have any more ideas or suggestions, please do let me know.

Thursday, 11 November 2010

Adam Price is right -- and I can prove it.

As far as I'm concerned Adam Price, the ex-Plaid Cymru MP and leadership contender, hit the nail squarely on the head when he told a BBC Wales programme yesterday that:

He also went on to say:

I couldn't agree more. In our current straightened times all politics is economics -- and accordingly we need politicians with some understanding of where wealth comes from, how to use it wisely, and, most importantly, and how to invest in skills, infrastructure, and business so as to generate more of it. Unfortunately the vast majority of our current Assembly Members are drawn exclusively from the public sector and have never had to create any wealth themselves. (Please note that I am not attacking civil servants, I am just saying that they are vastly over-represented as a group thus depriving the Assembly of other equally valuable life experiences and outlooks).

Don't believe me? Take a look at the below 'Druid Research Centre' analysis of the backgrounds of all 60 of our Assembly Members to see what life and work experience they had before becoming full-time politicians. Here are the results for the ruling coalition of Labour and Plaid Cymru Assembly Members:

It is imperative for a country like Wales, struggling as it is with high unemployment and a dwindling industrial- and business-base, to have more private-sector and wealth creating experience in its national legislature. However as Adam Price correctly identifies, Welsh parties are drawing politicians "from a vanishingly small gene-pool" and really need to look deeply at themselves and ask why it is that they are attracting so few people from business backgrounds when there is such an obvious need for their skills and experience.

"a lack of skills amongst [Welsh Assembly] politicians is making it difficult to tackle big economic challenges".

He also went on to say:

"The gap between the problems we face in Wales and the skill-set of the people we're drawing in to politics is huge".

I couldn't agree more. In our current straightened times all politics is economics -- and accordingly we need politicians with some understanding of where wealth comes from, how to use it wisely, and, most importantly, and how to invest in skills, infrastructure, and business so as to generate more of it. Unfortunately the vast majority of our current Assembly Members are drawn exclusively from the public sector and have never had to create any wealth themselves. (Please note that I am not attacking civil servants, I am just saying that they are vastly over-represented as a group thus depriving the Assembly of other equally valuable life experiences and outlooks).

Don't believe me? Take a look at the below 'Druid Research Centre' analysis of the backgrounds of all 60 of our Assembly Members to see what life and work experience they had before becoming full-time politicians. Here are the results for the ruling coalition of Labour and Plaid Cymru Assembly Members:

|

| Welsh Assembly Ruling Coalition AMs - Click to enlarge |

Of 39 Labour and Plaid Cymru AMs, only 10 percent of them have ever had any private sector business experience. The overwhelming majority (62 percent) have worked in the public sector all their lives with the remainder coming from voluntary-sector, law, religion, media and politics backgrounds. When looked at through the lens of wealth creation - a staggering 87 percent of the Labour / Plaid coalition have never had a wealth-creating job (the Druid is using Adam Smith's definition of 'wealth creation' whereby materials, labour, land, and technology are combined in such a way as to capture a profit, i.e. excess above the cost of production). Is it really any surprise that Economic Development polices in Wales are not working when only a very tiny fraction of the government have ever had any wealth creating experience themselves?

Here are the breakdowns by party:

LABOUR

|

| Labour AMs - click to enlarge |

PLAID CYMRU

|

| Plaid Cymru AMs - click to enlarge |

CONSERVATIVES

|

| Conservative AMs - click to enlarge |

LIB DEMS

|

| Lib Dem AMs - click to enlarge |

The Lib Dems are frankly the worse of a very bad bunch - not a single Lib Dem AM has ever been anywhere near a business, comprised as they are of four ex-teachers and two ex-civil servants. But at least they are not in power - coalition partner Plaid Cymru on the other hand is almost equally bad with just one AM (Alun Ffred Jones) ever having had any wealth creating experience.

It is imperative for a country like Wales, struggling as it is with high unemployment and a dwindling industrial- and business-base, to have more private-sector and wealth creating experience in its national legislature. However as Adam Price correctly identifies, Welsh parties are drawing politicians "from a vanishingly small gene-pool" and really need to look deeply at themselves and ask why it is that they are attracting so few people from business backgrounds when there is such an obvious need for their skills and experience.

The Outer Hebrides outgrow Anglesey

Dylan Jones-Evans, Professor and Director of Enterprise and Innovation at the University of Wales, today continues his excellent and insightful investigation into the situation of Anglesey by taking a look at how the ten poorest areas in the UK (as measured by GVA per head) have performed relative to each other since 2001. The results can be seen in the below chart:

|

| Relative GVA per head compared to UK Average for the UK's 10 poorest regions |

As you can see, some regions have shown tremendous growth over the past seven years, whereas places like Anglesey, the valleys of South Wales, and Conway & Denbighshire have either continued to decline or stagnated. It is also worth noting that these figures presumably include the output from Anglesey Aluminium and other recently closed companies, making it certain that Anglesey's current GVA per head is even lower than shown here.

However what really stands out to me is how the Western Isles (also known as the Outer Hebrides) have transformed their position from second from the bottom to joint top over a period of just ten years. When we look at the map plotting the location of these ten poorest parts of the UK, we can see just how remarkable the performances of the Western Isles and of Caithness and Sutherland, and Ross Cromarty (i.e. the North East top of Scotland) in particular have been:

|

| Location of the top 10 poorest regions in the UK |

So, as you can see without (a) the benefit of an A55 linking it directly to the industrial cities of the Midlands; (b) a major port linking it to the capital of Ireland, or (c) even a bridge connecting it to the rest of the mainland, the Western Isles have managed to not only economically outperform us in Anglesey, but have also grown dramatically too. This map also makes it clear that simply blaming the peripheral location of Anglesey as the cause of all our problems is not enough -- most of the bottom ten regions are in relatively remote locations, yet the two most remote regions (Western Isles and the North East tip of Scotland) have somehow found a way to grow.

To me this indicates that, all other things being equal, there must be something fundamentally wrong with the Economic Development policies being followed by successive governments in Westminster, and in particular by the Welsh Assembly Government which need to be put right as soon as possible.

Wednesday, 10 November 2010

A reader asks IWJ, "why does Anglesey always come last?" (updated)

Following the revelations via Dylan Jones-Evans on Monday that less than 0.1 percent of European 'JEREMIE' funding spent in Wales so far has been obtained by Anglesey-based companies, a reader of this blog emailed Ieuan Wyn Jones to ask him why:

This morning he received a reply all the way from Cardiff Bay:

It is IWJ's reply to the issue of JEREMIE funding which is so revealing: no explanation as to why the take up on Anglesey has been so appallingly small, just a glib assertion that it is not allocated geographically. I have no doubt that that he is right -- but what is being asked of IWJ is this: has he as Anglesey's AM done done enough to ensure that businesses in his own constituency are aware that such funding is available? The figures would suggest not. Furthermore we know that Anglesey is the poorest place in the UK, we know that the island has lost over 2,000 private sector jobs over the past couple of years, therefore we need our Assembly Member to be doing everything in his power to ensure that his own constituency gets all the support it needs to return to growth. Unfortunately neither the JEREMIE funding take-up figures nor IWJ's reply above instill confidence.

UPDATE: Our correspondent replied to IWJ and has received another mail from the Minister:

To which IWJ replied:

Sent: Tuesday, November 09, 2010 11:45 AM

To: Wyn Jones, Ieuan (Assembly Member)

Subject: European Structural Funding allocated to Anglesey

Mr Jones,

As a long term resident of Anglesey I am appalled by the continual decline in investment and employment in this island. This situation is highlighted by the latest official data which shows that in the last three years only 111 businesses on the island have been helped through European convergence funding. In addition to this, only 102 new jobs have been created and only 18 new businesses have been set up. At the same time we have lost many large employers too well known to have to list.

I understand that Wales have access to the £150,000,000 JEREMIE fund which is providing commercial funding for small firms which face difficulties in obtaining funding.

According to figures released by the Welsh Assembly, £30 million has been spent in the whole of Wales, only £25,000 has been invested in Anglesey. This is less than 0.1% of the funding.

The figures tell us that Gwynedd has received 44 times more funding than your constituency, Conwy has received twice as much, Denbighshire 35 times more and Flintshire 77 times more. Why is this?

Are you, as either MP or AM for this island for many years, proud of this situation?

You are in a position of authority in the Welsh Assembly, why on earth do you not support the people who sent you there?

Please let me know what action you intend to take to correct this grossly unfair situation.

This morning he received a reply all the way from Cardiff Bay:

From: "Wyn Jones, Ieuan (Assembly Member)"

Date: 10 November 2010 08:26:18 GMT

Subject: Re: European Structural Funding allocated to Anglesey

I thank you for your e-mail and interest in these matters. The amount of convergence funding which Anglesey has access to is significantly higher than that quoted by you. I'll get the full figures.

Access to the Jeremie fund is by individual companies and not allocated geographically by the government. Indeed the fund is only a small proportion of the funding requirement of small businesses.

Anglesey has benefited significantly from a whole range of European funding streams as well as in providing funding for transport links in recent years.

I hope that you will continue to support all efforts in improving the island's economy including strengthening the economy department's role in North Wales.

Yours sincerely

Ieuan Wyn Jones

It is IWJ's reply to the issue of JEREMIE funding which is so revealing: no explanation as to why the take up on Anglesey has been so appallingly small, just a glib assertion that it is not allocated geographically. I have no doubt that that he is right -- but what is being asked of IWJ is this: has he as Anglesey's AM done done enough to ensure that businesses in his own constituency are aware that such funding is available? The figures would suggest not. Furthermore we know that Anglesey is the poorest place in the UK, we know that the island has lost over 2,000 private sector jobs over the past couple of years, therefore we need our Assembly Member to be doing everything in his power to ensure that his own constituency gets all the support it needs to return to growth. Unfortunately neither the JEREMIE funding take-up figures nor IWJ's reply above instill confidence.

UPDATE: Our correspondent replied to IWJ and has received another mail from the Minister:

Sent: Wednesday, November 10, 2010 10:16 AM

To: Wyn Jones, Ieuan (Assembly Member)

Subject: European Structural Funding allocated to Anglesey

Dear Mr Jones,

I am in receipt of your reply to my email on the above subject.

I look forward to receiving the figures concerning the amount of convergence funding to which Anglesey has access, as promised.

How much of these funds have been applied for and how much has been received and for what purposes? I would like answers to all three points.

You say that access to the JEREMIE fund is by individual companies, what are you doing specifically to make sure that companies know about these funds and how are you helping them to obtain them? Answer please.

You also say that the fund is only a small proportion of the funding requirements of small businesses, what are you doing the help them with any shortfall? Answer please.

You say that Anglesey has benefited significantly from a whole range of European funding streams. When we look at the fact that Anglesey is the poorest area in the United Kingdom there is no apparent improvement. Why are you not pushing harder to see that this island receives its fair share of funding? We get less than any other part of Wales. Is there a good reason for this state of affairs?

With regard to the funding for transport links, are you refering to the massive subsidy to the Valley - Cardiff air link? I am sure it is of great help to some people!

You conclude by saying that you hope I will continue to support efforts to improve the island's economy, could you list some concrete examples of your achievements in this direction?

To which IWJ replied:

From: "Wyn Jones, Ieuan (Assembly Member)"

Date: 10 November 2010 12:08:45 GMT

Subject: Re: European Structural Funding allocated to Anglesey

I have made a note of your continuing concerns to which I will respond to in due course. The Jeremie fund is extensively marketed as well as other sources of funding

It is not true to say that Anglesey receives less support from government funding than other counties. The regen project Mon a Menai is one of a limited number of SRA's in the whole of Wales.

Ieuan Wyn Jones

Monday, 8 November 2010

Why does Anglesey always come last?

In his blog today, Dylan Jones-Evans reveals some very disturbing information about how Anglesey is being seriously left behind in terms of European structural funding:

The JEREMIE (Joint European Resources for Micro to Medium Enterprises) project is very interesting in that it provides exactly the kind of support which Anglesey needs right now, i.e. loans for small and medium enterprises (SMEs) that are currently facing difficulties in securing funding from banks. Considering that Anglesey has lost the majority of its larger firms over the past few years, to secure any kind of economic growth on the Island we have to strategically focus on our indigenous small firms. Yet as Dylan Jones-Evans points out, Anglesey's SMEs has been the recipient of less than 0.1 percent of the total JEREMIE funding spent in Wales to date. To put that into perspective, lets see how other Welsh regions have done compared to Anglesey:

"But as we know, Anglesey, as the poorest county within the whole of the UK, has the advantage of being able to access £2 billion pounds of European Structural funding in order to create jobs and new businesses to alleviate the effects of the recession.

Unfortunately, that has simply not happened.

The latest official data shows that, in the last three years, only 111 businesses on Anglesey have been helped through European convergence funding.

Worse still, only 102 new jobs have been created and just 18 new businesses set up.

Remember this is at a time when Wales was going though the worst downturn since the 1920s and hundreds of jobs were lost on Anglesey.

But that is not the whole story.

Wales is also fortunate to have access to the £150 million JEREMIE fund that is providing commercial funding solutions for small firms that face difficulties in securing funding.

Yet, according to the latest figures released by WAG, whilst £30 million has been spent across Wales, only £25,000 has been invested on Anglesey i.e. less than 0.1 per cent of funding for entrepreneurs has gone to the poorest county in Wales."

The JEREMIE (Joint European Resources for Micro to Medium Enterprises) project is very interesting in that it provides exactly the kind of support which Anglesey needs right now, i.e. loans for small and medium enterprises (SMEs) that are currently facing difficulties in securing funding from banks. Considering that Anglesey has lost the majority of its larger firms over the past few years, to secure any kind of economic growth on the Island we have to strategically focus on our indigenous small firms. Yet as Dylan Jones-Evans points out, Anglesey's SMEs has been the recipient of less than 0.1 percent of the total JEREMIE funding spent in Wales to date. To put that into perspective, lets see how other Welsh regions have done compared to Anglesey:

|

| JEREMIE investments in SMEs by region (£000s) click to enlarge |

So, our neighbour Gwynedd has received 44 times more funding than Anglesey, Conwy twice as much, Denbighshire 35 times more, and Flintshire a staggering 77 times more.

One has to ask why so little of this funding is being accessed by Anglesey's companies? Our AM, Ieuan Wyn Jones, always manages to find time to slam the coalition government for any perceived "lack of respect" for the Welsh economy, yet strangely fails to find any time to actually ensure that his constituency's small businesses are taking full advantage of available funding options -- despite them being administered by his own department. Time to go, Ieuan...

Tuesday, 2 November 2010

Crowded house: the Welsh economy

|

| The Welsh Economy |

The first study, by Harvard Business School academics, investigates whether higher government spending can "crowd out" private consumption and investment -- i.e. the phenomenon were government uses up financial and other resources (including personnel) that would otherwise be used by private enterprise. As an 'economy' is basically an aggregate of the actions of literally hundreds of millions of different people and organisations making diverse informed decisions on how to spend their money, the biggest problem faced by economists is to isolate just the factors they want to study -- in this case what influence increased government spending has on the private sector -- however the Harvard Business School academics hit on a very ingenious solution:

"When American politicians become chairmen of congressional committees, they are able to direct federal spending to their home states. To take one example, Richard Shelby, a Republican from Alabama, became chairman of the Senate intelligence committee in 1997. Before that Alabama averaged $6m less in annual federal earmarks, or specific funding, than other states. After his appointment the state received $90m more than the average.

Chairmanships are based on seniority. They require another senator or congressman to lose their seat. Appointments have little relationship with economic activity in the state concerned, and extra spending will occur at all stages of the [business] cycle. It is a truly independent variable.

The academics examined 232 appointments across 42 years. They found the average state receives a 40-50% boost in earmarks in the year following a chairman’s appointment, an increase that persisted for the rest of his tenure. Private firms reacted by reducing capital expenditure (by 8-15%) and research and development (by 7-12%); employment and sales growth also suffered. This test appears fairly robust, as it covered a wide variety of states and was also reversed when the chairman stood down."

Furthermore the second study highlighted by The Economist and conducted by academics associated with the OECD discovered through statistical analysis of a panel of 145 countries between 1960 to 2007, that a 1% rise in government consumption as a share of GDP eventually reduced private-sector consumption by 1.9%.

If these findings are correct, what does this tell us about the Welsh economy were public spending as a share of GDP has, according to the latest figures, reached 69.1% -- second only in its reliance on the public sector to Northern Ireland?

|

| Public spending as a share of GDP (source: CEBR) |

I have previously written how, despite the Welsh Assembly spending more per capita than any other UK region on economic development, Wales still remains at or near the bottom of most indicators of economic health such as GVA, unemployment and business failures. The Institute of Welsh Affairs, which commissioned the research (and which counts the sainted Gerry Holtham on its management board), opined that the causes for this underperformance were general cack-handedness and a lack of accountability and transparency. However, bearing in mind the results of the above studies, is it not more likely that the growth of the Welsh private sector is in fact being artificially stunted due to the crowding-out effects of an overlarge public sector? It surely cannot be healthy for Wales that the government spends £7 out of every £10 spent in this country.

Furthermore, in the past both Rhodri Morgan and Ieuan Wyn Jones have given speeches saying that the problem is not that the Welsh public sector is too large, but that the private sector is too small. But surely this is putting the cart before the horse -- under normal circumstances a country can only afford a public sector which can be sustainably paid for by its private sector. If the findings of the above studies are correct then they will have profound implications on our understanding of why the Welsh private sector is so stunted.

(Finally, before I am accused of hypocrisy for having called for Welsh Assembly support for the port of Holyhead just days ago, please note there is a big difference between targeted and limited government support and a structurally over-large public sector.)

Thursday, 16 September 2010

At last some radical economic thinking from an Assembly Member..!

The Druid has long argued (most recently here) that the most effective way of promoting economic growth in Anglesey and in Wales as a whole would be to strategically reduce the rate of corporation tax levied here. I am delighted therefore to read an interview in today's Western Mail with the Welsh Conservative AM, David Melding, where he advocates exactly the same policy:

For too long successive governments have tried to counterbalance the concentration of private businesses in the South East of England (where they have access to the largest market, complementary service companies, and easy international links, etc) through the apparatus of the state. Regional Development Agencies, staffed by hundreds of bureaucrats, have sought to tempt businesses to set up in their localities through the blunt instruments of offering non-repayable grants or tax holidays. This strategy has been flawed from the outset for two reasons:

My point is that in order to generate sustainable economic growth in Wales, it is necessary to create a business environment which has an in-built competitive advantage over other regions, and were that advantage is available to all companies -- not just the ones favoured by a few bureaucrats. A reduced rate of Corporation Tax in Wales would deliver this and I am delighted to see that David Melding AM seems to get it. However, that said, so far the Welsh Assembly has completely failed to create a competitive advantage for Welsh businesses. The only economic lever which the Assembly has full control over is the setting of Business Rates (a devolved matter) and yet as I pointed out the other day, Business Rates in Wales are the highest in the United Kingdom.

We need more radical thinking in the Welsh Assembly along the lines which David Melding is suggesting.

“What I would suggest is that if Wales really wants to be enterprising and attract investors who want to stay here ... the best thing we could do is lower the level of corporation tax, the tax that companies have to pay, but perhaps look at something quite radical like the top rate of income tax and lowering that, so that people who are higher earners – and there aren’t many in Wales – come to Wales and start up businesses, and because they do that they are able to retain more of the wealth they are generating.

“I really think that is the only way to tackle the long-term economic poverty that we have in Wales, compared to many other regions in Britain. We’ve really got to have a tax policy in Wales that’s a bit different to that in the south east of England or London.”

For too long successive governments have tried to counterbalance the concentration of private businesses in the South East of England (where they have access to the largest market, complementary service companies, and easy international links, etc) through the apparatus of the state. Regional Development Agencies, staffed by hundreds of bureaucrats, have sought to tempt businesses to set up in their localities through the blunt instruments of offering non-repayable grants or tax holidays. This strategy has been flawed from the outset for two reasons:

- The Agencies have attempted to "pick winners", i.e. select which firms they believe should succeed and then showered them with grants. First of all, as any honest stockbroker will tell you, picking winners is a very, very difficult game. Secondly, this process has been 'self selecting' insomuch that only those companies which are aware of the opportunities have applied for assistance -- in many cases multiple times once they have figured out how to play the system.

- These regional agencies have not been able to bring about any meaningful change in the business environment in their regions, meaning that when the grants run out or the tax holiday ends, the original reason why those companies set up in that region in the first place is removed. Then, like the experience with many multinationals in South Wales, they then shift their manufacturing to lower cost countries.

My point is that in order to generate sustainable economic growth in Wales, it is necessary to create a business environment which has an in-built competitive advantage over other regions, and were that advantage is available to all companies -- not just the ones favoured by a few bureaucrats. A reduced rate of Corporation Tax in Wales would deliver this and I am delighted to see that David Melding AM seems to get it. However, that said, so far the Welsh Assembly has completely failed to create a competitive advantage for Welsh businesses. The only economic lever which the Assembly has full control over is the setting of Business Rates (a devolved matter) and yet as I pointed out the other day, Business Rates in Wales are the highest in the United Kingdom.

We need more radical thinking in the Welsh Assembly along the lines which David Melding is suggesting.

Is a 5-day strike at Vion Llangefni the right way to go?

I have to admit to a feeling of deep unease over the announcement that 200 staff at the Vion ("Chuckies") chicken processing plant in Llangefni will start a five day strike from next Monday. The strike is in protest at Vion's offer of a 2% wage rise -- the Unite union argued that this is unacceptable considering that inflation is currently running at 3.1%.

The Llangefni plant is operated by the Dutch owned Vion Food Group, which produces and processes beef, lamb, pork bacon and chicken, as well as products such as sausages and cooked meats. The company employs 350 workers in its Llangefni chicken plant and a further 240 at the Welsh Country Foods abattoir in Gaerwen -- as such Vion is one of Anglesey's largest employers. Over the past year, Vion has already shed 140 jobs in the Llangefni plant when it moved to just one shift, and a further 200 jobs were lost at Welsh Country Foods in Gaerwen when the company shifted its retail packaging operation to Winsford in Cheshire.

The newspaper report in today's Holyhead & Anglesey Mail makes no reference to a vote having been held or the margin by which such a vote was won. As the plant employs 350 people, yet only 200 are striking, it suggests that the decision to strike is by no means unanimous amongst all workers at the plant.

Although I recognise that the pay rise is below inflation, one would hope that opting to strike would be very much the last resort -- especially as a five day strike seems to be extraordinarily prolonged in this day and age. This is particularly so when you consider that currently only 15% of private sector workers are unionised, and if we knock out those ex-public sector areas such as utilities, the railways and British Airways, the private sector rate falls to well below 10%. Also with Vion's profit margin running at just 0.7% of turnover according to their 2009 Annual Report (Dutch), it doesn't seem that Vion is currently making vast profits either.

My fear is that industrial action on this scale in a private business, possibly promoted by the Unite union not only for the merits of this particular case, could have damaging implications on Vion's future presence on Anglesey. This fear is compounded by the quote in the H&A Mail by a Vion spokesman, who said ominously, "the business will continue to focus on providing uninterrupted supply to its customers". How difficult would it be for Vion to shift production to another plant -- without a unionised workforce? What knock-on effects will a strike by the Llangefni plant have on the prospects of the Gaerwen plant? I hope that all of these questions have been considered soberly and carefully by both Unite and the workers involved before opting to strike.

The Llangefni plant is operated by the Dutch owned Vion Food Group, which produces and processes beef, lamb, pork bacon and chicken, as well as products such as sausages and cooked meats. The company employs 350 workers in its Llangefni chicken plant and a further 240 at the Welsh Country Foods abattoir in Gaerwen -- as such Vion is one of Anglesey's largest employers. Over the past year, Vion has already shed 140 jobs in the Llangefni plant when it moved to just one shift, and a further 200 jobs were lost at Welsh Country Foods in Gaerwen when the company shifted its retail packaging operation to Winsford in Cheshire.

The newspaper report in today's Holyhead & Anglesey Mail makes no reference to a vote having been held or the margin by which such a vote was won. As the plant employs 350 people, yet only 200 are striking, it suggests that the decision to strike is by no means unanimous amongst all workers at the plant.

Although I recognise that the pay rise is below inflation, one would hope that opting to strike would be very much the last resort -- especially as a five day strike seems to be extraordinarily prolonged in this day and age. This is particularly so when you consider that currently only 15% of private sector workers are unionised, and if we knock out those ex-public sector areas such as utilities, the railways and British Airways, the private sector rate falls to well below 10%. Also with Vion's profit margin running at just 0.7% of turnover according to their 2009 Annual Report (Dutch), it doesn't seem that Vion is currently making vast profits either.

My fear is that industrial action on this scale in a private business, possibly promoted by the Unite union not only for the merits of this particular case, could have damaging implications on Vion's future presence on Anglesey. This fear is compounded by the quote in the H&A Mail by a Vion spokesman, who said ominously, "the business will continue to focus on providing uninterrupted supply to its customers". How difficult would it be for Vion to shift production to another plant -- without a unionised workforce? What knock-on effects will a strike by the Llangefni plant have on the prospects of the Gaerwen plant? I hope that all of these questions have been considered soberly and carefully by both Unite and the workers involved before opting to strike.

Thursday, 9 September 2010

Overrated: New Welsh Business Rates relief scheme still less generous than in England and Scotland

Yesterday the Welsh Assembly Government let it be known that from 1 October 2010 until 30 September 2011, it would temporarily increase relief for Business Rates in Wales. According to the press release:

Of course for small businesses in Wales this is very welcome news indeed - however in order to fully assess its value we need to understand how the previous relief scheme stacked up against other regions in the UK (as due to the devolved structure of the UK, England, Scotland and Wales all now have different Business Rates relief schemes).

All businesses make a contribution to local government services through what is known as 'Non Domestic Rates' (a.k.a. 'Business Rates') based on a valuation of their property by the Valuation Office Agency (VOA). The rates payable are calculated by multiplying the valuation of the property by a 'multiplier' determined each year by either the Welsh Assembly Government in Wales, the Communities and Local Government Department in England, and the Scottish Executive in Scotland. Accordingly, if a property used by a business in Wales has a rateable value of £20,000 for example, its business rates bill would be calculated by multiplying £20,000 by the Wales multiplier (40.9 pence in the pounds for 2010/11) giving the business a bill of £8,180 for 2010. However, in order to help small businesses in particular, each of the regions operate a relief scheme whereby eligible businesses are given discounts on their bill according to the rateable value of their property. Below is a summary and comparison I have made of the various business rates relief schemes as currently operated in England, Scotland and Wales:

As you can see, the business rates relief scheme in Wales has been far less generous towards smaller businesses than comparable schemes in England and, particularly, Scotland where since April this year all businesses with a rateable value of less than £10,000 have been lifted out of paying completely. To illustrate how much more comparable Welsh businesses have to pay than their English or Scottish counterparts, I have calculated the business rates payable for businesses in each of the three regions at five different bands:

As you can see, businesses in Wales with a rateable value of around £10,000 or less pay considerably more than comparable businesses in England, whilst the same businesses in Scotland pay nothing!

However, as I noted at the beginning of this post, the Welsh Assembly Government has now introduced an increased relief scheme for Wales which will lift all businesses with a rateable value less than £6,000 out of paying business rates at all - great, right? Well, up to a point, yes - but the fact is that the WAG scheme is identical in all particulars to the one announced (pdf) in England in July this year. And because WAG has anyway set a slightly higher multiplier for Welsh businesses (40.9p compared to 40.7p in England and Scotland), Welsh businesses still have to pay more than their English and Scottish counterparts - as the following calculations based on the temporary relief scheme show:

Its worth noting that businesses in Scotland continue to pay less even when compared to the new temporary schemes introduced in England and Wales!

So, in conclusion, it would be curmudgeonly of me not to welcome the new levels of business relief in Wales - they are sorely needed. However it is essential that we recognise that small businesses in Wales are still at a competitive disadvantage compared to small businesses anywhere else in the UK.

Small businesses are the backbone of the Welsh economy - they employ more people and contribute to their localities by complementing and supporting other local businesses. With an overlarge Public Sector in Wales it is essential that we do everything we can to grow our homegrown small businesses - however, as the above comparisons show, in the one area where the Welsh Assembly Government has complete freedom to create a competitive advantage for our small businesses, it has comprehensively failed. And our AM, Ieuan Wyn Jones, as Minister for Economy and Transport, has to take a large part of the responsibility for that.

"Most business premises with a rateable value up to £6,000 will not pay any business rates and most of those with a rateable value between £6,001 and £12,000 will receive rate relief that will be reduced on a tapered basis. This means that business premises with a rateable value of £8,000 will get around 66% rate relief; whilst those with a rateable value of £10,000 will get around 33% relief."

Of course for small businesses in Wales this is very welcome news indeed - however in order to fully assess its value we need to understand how the previous relief scheme stacked up against other regions in the UK (as due to the devolved structure of the UK, England, Scotland and Wales all now have different Business Rates relief schemes).

All businesses make a contribution to local government services through what is known as 'Non Domestic Rates' (a.k.a. 'Business Rates') based on a valuation of their property by the Valuation Office Agency (VOA). The rates payable are calculated by multiplying the valuation of the property by a 'multiplier' determined each year by either the Welsh Assembly Government in Wales, the Communities and Local Government Department in England, and the Scottish Executive in Scotland. Accordingly, if a property used by a business in Wales has a rateable value of £20,000 for example, its business rates bill would be calculated by multiplying £20,000 by the Wales multiplier (40.9 pence in the pounds for 2010/11) giving the business a bill of £8,180 for 2010. However, in order to help small businesses in particular, each of the regions operate a relief scheme whereby eligible businesses are given discounts on their bill according to the rateable value of their property. Below is a summary and comparison I have made of the various business rates relief schemes as currently operated in England, Scotland and Wales:

|

| Click to enlarge |

As you can see, businesses in Wales with a rateable value of around £10,000 or less pay considerably more than comparable businesses in England, whilst the same businesses in Scotland pay nothing!

However, as I noted at the beginning of this post, the Welsh Assembly Government has now introduced an increased relief scheme for Wales which will lift all businesses with a rateable value less than £6,000 out of paying business rates at all - great, right? Well, up to a point, yes - but the fact is that the WAG scheme is identical in all particulars to the one announced (pdf) in England in July this year. And because WAG has anyway set a slightly higher multiplier for Welsh businesses (40.9p compared to 40.7p in England and Scotland), Welsh businesses still have to pay more than their English and Scottish counterparts - as the following calculations based on the temporary relief scheme show:

Its worth noting that businesses in Scotland continue to pay less even when compared to the new temporary schemes introduced in England and Wales!

So, in conclusion, it would be curmudgeonly of me not to welcome the new levels of business relief in Wales - they are sorely needed. However it is essential that we recognise that small businesses in Wales are still at a competitive disadvantage compared to small businesses anywhere else in the UK.

Small businesses are the backbone of the Welsh economy - they employ more people and contribute to their localities by complementing and supporting other local businesses. With an overlarge Public Sector in Wales it is essential that we do everything we can to grow our homegrown small businesses - however, as the above comparisons show, in the one area where the Welsh Assembly Government has complete freedom to create a competitive advantage for our small businesses, it has comprehensively failed. And our AM, Ieuan Wyn Jones, as Minister for Economy and Transport, has to take a large part of the responsibility for that.

Tuesday, 7 September 2010

Towards regional rates of Corporation Tax

Jonathan Edwards, the Plaid Cymru MP, has called on the Westminster Government to match in Wales the 'special measures' which have been promised to Northern Ireland, such as lower corporation tax and enterprises zones to help stimulate growth and jobs there. Looking at the various statistics it is clear that Wales and Northern Ireland have very similar levels of unemployment, regional GVA and high public sector employment - though it could be argued that because the neighbouring Republic of Ireland's rate of corporation tax is just 12.5%, Northern Ireland is on an especially sticky wicket when it comes to trying to attract inward investment.

Anyway, what I find dissatisfying in this whole affair is the piecemeal nature of the promise of action in Northern Ireland but not elsewhere - despite similar levels of need. It seems to me that the N.I. special measures are dependent on special pleading - Northern Ireland's politicians have obviously managed to make their case to the Coalition far more effectively than our own Welsh politicians who appear to be more interested in in-fighting (think of the situation in own beloved Anglesey, but writ large).

Anyway, it therefore occurs to me that the fairest and most equitable solution would be to introduce variable levels of corporation tax (and possibly business rate relief, etc.) in the UK based on relative regional GVA indices. I understand that Gerry Holtham has proposed something similar, but here's my own modest proposal.

Gross Value Added (GVA) measures the contribution to the economy of each individual producer, industry or region in the UK and is an important measure in the estimation of the nation's total Gross Domestic Product (GDP). However, GVA has also become the preferred measure of the Government in assessing the overall economic well-being of an area. As such it is the ideal yardstick to use in comparing the relative need of different UK regions for variable rates of corporation tax. I would propose the following system:

Such a system would produce the following results (note this is just a selection of NUTS2 regions, not the entire list). For the sake of clarity, using NUTS2 regional subdivisions, Wales would be divided into two regions:

In terms of the cost of introducing such a system, it would be tempting to offset the costs of reducing corporation tax in some regions by raising it in other more 'profitable' regions. I would resist this temptation in order to ensure that the country as a whole is competitive internationally. I do not have the entire resources of the Treasury at my disposal so cannot attempt to cost this proposal accurately, but one would hope that lower regional rates of corporation tax would incentivise many companies to relocate from the South East to other areas providing much needed unemployment and other benefits. Hopefully a large portion of the cost therefore of reducing the corporation tax could be recouped through lower social security and other current government expenditures in those regions.

The advantages of such a system would be to ensure that all regions are treated equitably (and without the distorting effect of special pleading) and according to their need. Should the GVA of the various regions rise, then the rates of corporation tax will also rise accordingly and vice versa. I would be very interested in your views on such a system.

A full list of the GVA per head indices for all NUTS2 regions are below for your perusal:

GVA Per Head Indices UK

Anyway, what I find dissatisfying in this whole affair is the piecemeal nature of the promise of action in Northern Ireland but not elsewhere - despite similar levels of need. It seems to me that the N.I. special measures are dependent on special pleading - Northern Ireland's politicians have obviously managed to make their case to the Coalition far more effectively than our own Welsh politicians who appear to be more interested in in-fighting (think of the situation in own beloved Anglesey, but writ large).

Anyway, it therefore occurs to me that the fairest and most equitable solution would be to introduce variable levels of corporation tax (and possibly business rate relief, etc.) in the UK based on relative regional GVA indices. I understand that Gerry Holtham has proposed something similar, but here's my own modest proposal.

Gross Value Added (GVA) measures the contribution to the economy of each individual producer, industry or region in the UK and is an important measure in the estimation of the nation's total Gross Domestic Product (GDP). However, GVA has also become the preferred measure of the Government in assessing the overall economic well-being of an area. As such it is the ideal yardstick to use in comparing the relative need of different UK regions for variable rates of corporation tax. I would propose the following system:

- The system would be based on headline GVA per head indices for NUTS2 regions (a subdivision of the UK used by the Office for National Statistics whereby the the UK is divided into 37 subregions)

- In regions where the GVA per head index is at 90 or above: no change to corporation tax.

- In regions where the GVA per head index is between 80-89: a reduction in the corporation tax by one percentage point.

- In regions where the GVA per head index is between 70-79: a reduction in the corporation tax by two percentage points.

- And so on...

Such a system would produce the following results (note this is just a selection of NUTS2 regions, not the entire list). For the sake of clarity, using NUTS2 regional subdivisions, Wales would be divided into two regions:

- West Wales and The Valleys (Anglesey, Gwynedd, Conwy and Denbighshire, South West Wales, Central Valleys, Gwent Valleys, Bridgend and Neath Port Talbot, Swansea)

- East Wales (Monmouthshire and Newport, Cardiff and Vale of Glamorgan, Flintshire and Wrexham, Powys)

In terms of the cost of introducing such a system, it would be tempting to offset the costs of reducing corporation tax in some regions by raising it in other more 'profitable' regions. I would resist this temptation in order to ensure that the country as a whole is competitive internationally. I do not have the entire resources of the Treasury at my disposal so cannot attempt to cost this proposal accurately, but one would hope that lower regional rates of corporation tax would incentivise many companies to relocate from the South East to other areas providing much needed unemployment and other benefits. Hopefully a large portion of the cost therefore of reducing the corporation tax could be recouped through lower social security and other current government expenditures in those regions.

The advantages of such a system would be to ensure that all regions are treated equitably (and without the distorting effect of special pleading) and according to their need. Should the GVA of the various regions rise, then the rates of corporation tax will also rise accordingly and vice versa. I would be very interested in your views on such a system.

A full list of the GVA per head indices for all NUTS2 regions are below for your perusal:

GVA Per Head Indices UK

Tuesday, 27 July 2010

Can Holyhead learn from Liverpool?

|

| Holyhead Town Centre: terminal decline? |

|

| Liverpool One: a shopping mall integrated into the City Centre |